Osgli Osgli Prudential Com - VGLI is a life insurance policy for veterans and military retirees. VGLI life insurance is only available if you had group life insurance (SGLI) during your service.

SGLI is much more valuable because it covers any cause of death. VGLI, on the other hand, has average coverage and rates increase dramatically as you age. The most valuable feature of VGLI is that as long as you have coverage, you can convert it to a whole life insurance policy with a higher insurer without proving your health.

Osgli Osgli Prudential Com

SGLI is a term life insurance policy that automatically enrolls all active duty members, as well as members of the Ready Reserve and National Guard. Unlike a regular life insurance policy, the term of SGLI coverage is simply the time you are on active duty, plus 120 days after that.

Adjutant General School

Veterans Affairs (VA) offers life insurance for service members because many life insurance policies specifically exclude coverage for deaths due to acts of war or terrorism. SGLI covers all situations and beneficiaries even receive a death benefit in the event that the service member dies by suicide.

You can have between $50,000 and $400,000 in SGLI coverage and be automatically enrolled in the maximum amount. SGLI monthly rates are just $0.06 per $1,000 death benefit, and you can add traumatic injury protection for $1 per month. So if you had $400,000 coverage, your monthly premium would be $25 with traumatic injury protection.

SGLI also offers the option to accelerate up to 50% of your policy's death benefit (get it while you're still alive) if you or your partner become terminally ill. This benefit is common, but usually only applies to the policyholder.

When you leave active duty, you must convert your SGLI policy to a VGLI policy within one year and 120 days. Veterans who submit their conversion application within 240 days of discharge are not required to answer questions about their health. After this period, you must complete a health questionnaire. After 485 days you can no longer apply for a VGLI policy.

House Sends Rep. Mike Levin's Bill Strengthening Servicemembers' Life Insurance To President's Desk

Since you convert the SGLI policy, your VGLI life insurance has the same coverage. However, if you have reduced your SGLI death benefit and want additional coverage, you can increase the size of your VGLI policy by $25,000 every five years (until your death benefit reaches $400,000 or you turn 60, whichever comes first). occurs). Although VGLI policies are term life insurance, they renew each year and are available for life.

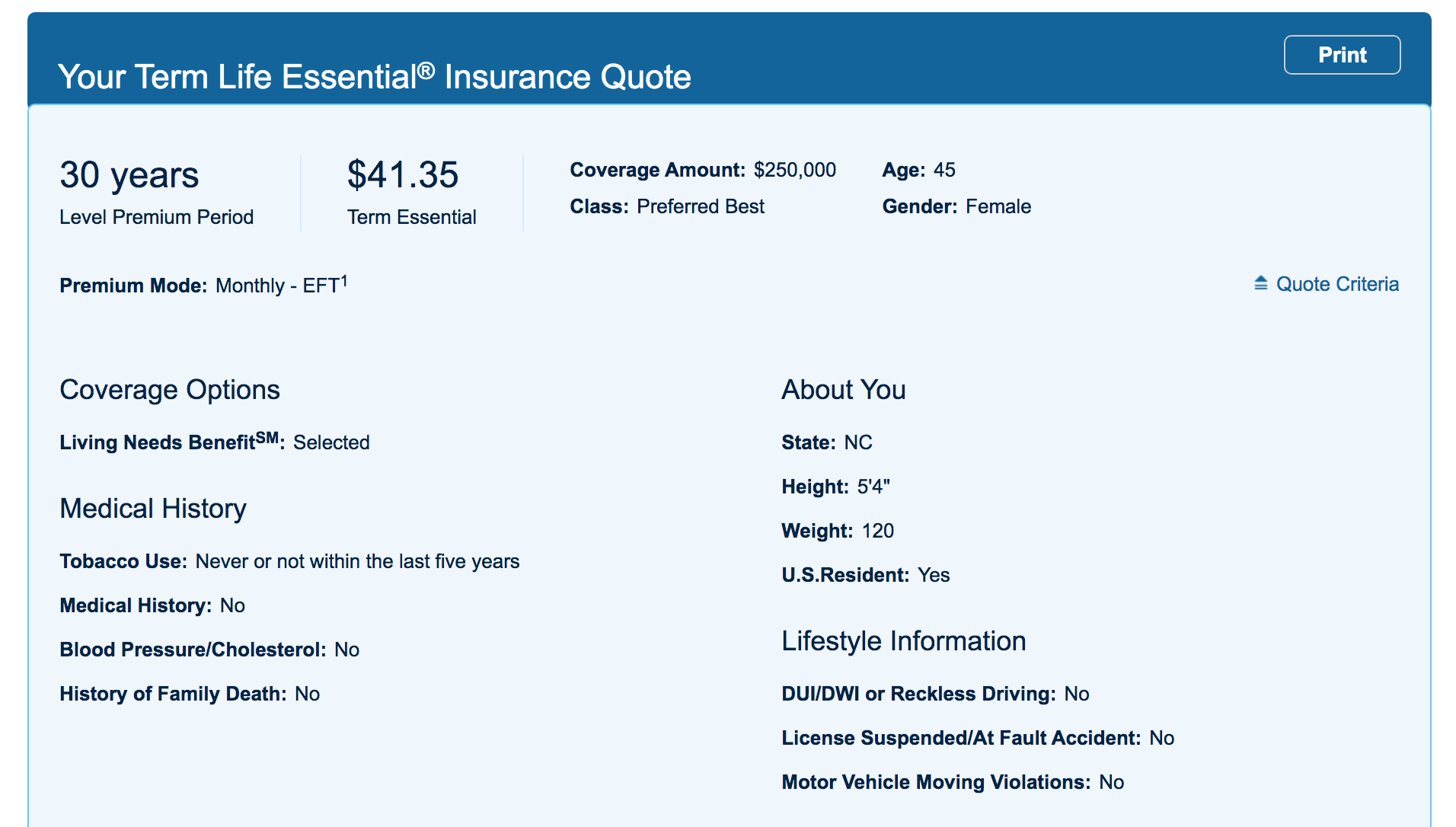

VGLI premiums are determined only by your age and the amount of coverage you have. Other factors, such as tobacco use and weight, are not included in the price. While this means that VGLI life insurance rates are great for overweight smokers and pre-existing medical conditions, they are medium to high for healthy veterans. In addition, the premiums increase every five years if a new age category is introduced (for example, 30 to 34 years).

We compared the cost of 50 years of coverage through VGLI to the cost of purchasing term or whole life insurance for the same period through USAA. As you can see, VGLI rates are competitive for a young veteran, but quickly exceed the cost of a whole life insurance policy. Over a 50-year period, you'll pay 39% more for VGLI than for a whole life insurance policy.

The sample life insurance rates are for a 30-year-old male in excellent health who purchases $250,000 worth of coverage. Sample life insurance rates are based on an initial 30-year policy and a 20-year policy purchased at age 60.

Veterans' Group Life Insurance (vgli)

Given the high premiums, we advise you to convert your VA life insurance policy to an individual life insurance policy instead of VGLI. SGLI policies and VGLI policies can be converted into permanent cover with insurers that the Office of Service Group Life Insurance (OSGLI) works with. Partners include most major life insurance companies, such as MetLife, New York Life, and Northwestern Mutual.

While you can only convert to a permanent policy, such as a full or universal life insurance policy, you don't need to prove you're in good health.

Similarly, while OSGLI also offers life insurance specifically for disabled veterans, it has very limited coverage ($10,000 death benefit) and rates rise over time.

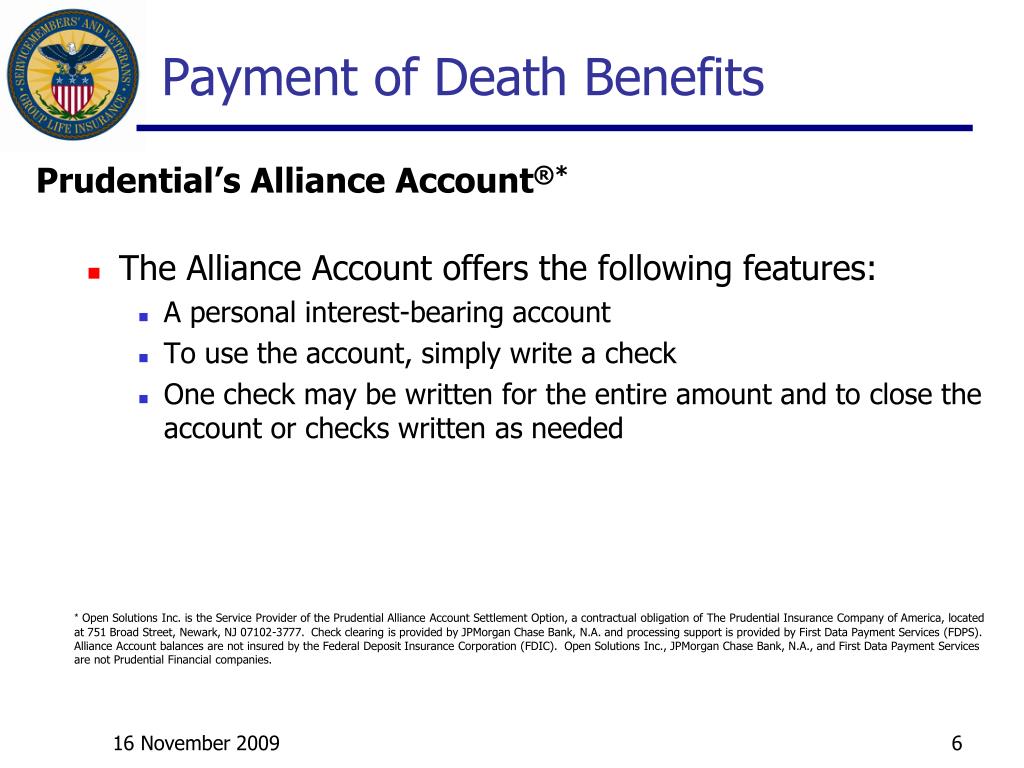

VGLI is offered through Prudential. You can create an account and manage everything related to OSGLI payments online, as well as update payees and change your payment schedule to monthly, quarterly or yearly.

Lawyers With Purpose: Va

Claims are also handled directly through Prudential, not OSGLI. As with any life insurance policy, make sure your beneficiaries know about the policy and have a copy in case they need to make a claim.

To get an insurance quote over the phone, call: (855) 596-3655 | Agents available 24 hours a day, 7 days a week! Sara Routhier, editor-in-chief and director of outreach, has professional experience as a teacher, SEO specialist and content marketer. He has more than five years of experience in the insurance industry. As a researcher, data nerd, writer and editor, she strives to create educational and insightful articles that bring you the must-have facts and best-kept secrets in the overwhelming world of…

Advertiser Disclosure: We are committed to helping you make safe life insurance decisions. Comparing should be easy. We are not affiliated with any life insurance company and cannot guarantee quotes from any provider. Our associations with the life insurance industry do not affect our content. Our opinions are ours. To compare quotes from many different companies, enter your zip code on this page to use the free quote tool. The more quotes you compare, the more chance you have of saving.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective third-party resource for all things life insurance. We update our site regularly and all content is reviewed by life insurance experts.

Prudential Change Of Ownership Form: Fill Out & Sign Online

Prudential has a proven track record in insuring individuals and offering group insurance. They are able to form strong relationships with their corporate clients, enabling them to do what they do best: provide insurance based on the specific needs of their clients.

As you will see, Prudential has the experience, tools, skills, knowledge base and a wide variety of insurance plans that are sure to fit your specific personal and financial needs as you plan for your future.

Want to see what rates you can get for life insurance? Get a quote now using our FREE tool above.

A life insurance company's financial ratings are important and directly affect its position in the life insurance market. Potential customers look at a company's reviews as part of their life insurance research. Prudential maintains high quality credit ratings with all rating agencies.

Military Veterans' Group Life Insurance

BEN Mellor rates an insurance company on its ability to meet its insurance obligations to its policyholders. Prudential has an A+ rating, a superior rating, from A.M. Best: The highest score given by this rating agency.

While Prudential is not accredited with the Better Business Bureau (BBB), it was rated a C- due to the 82 complaints filed against them in the past three years. However, 54 of the complaints were closed in the past 12 months.

Moody's assesses an insurance company's creditworthiness and ability to pay for promises made to policyholders. Prudential received an AA3, which stands for high quality with very low credit risk.

Standard & Poor's also assesses a company's creditworthiness and the likelihood that a debt will be repaid. Prudential received an AA- from S&P, demonstrating that they are highly capable of servicing debt.

What Is Vgli: Life Insurance After The Military

Fitch Ratings is very similar to S&P and assesses a company's creditworthiness and return on investment. Prudential has been awarded an AA, which gives them a high quality rating.

The NAIC Complaint Index records complaints against an insurance company. The average complaint rate is 1.00, so insurance companies want their numbers to be lower. Prudential has a complaint rate of 0.94 for individual life and 0.21 for collective life for 2018.

JD Power rates companies based on surveys, pricing, products offered and overall customer satisfaction and ranks Prudential with three out of five stars. A score of four or higher indicates "better than most."

Prudential Life Insurance is an American Fortune 500 company and is the largest insurance company in the United States. Prudential was originally founded in 1875 in New Jersey as the Widows and Orphans Friendly Society. Initially, they only sold funeral insurance.

Life Insurance And Interpleader Lawsuit |brochu Law

Early policyholders paid just 3 cents a week in premiums, making life insurance affordable for working-class families.

Over time, Prudential changed from a mutual company to a corporation and is now listed on the New York Stock Exchange.

Compared to other insurance companies, Prudential holds a steady No. 5 position in individual life insurance with more than $5 billion in written premiums and a market share of between 4.2 and 4.5 percent over the four years

With regard to group life insurance, Prudential ranked

Vgli Life Insurance: Decent Rates For Veterans

Gi osgli prudential, osgli com, osgli prudential life insurance, prudential insurance com, osgli prudential com, retirement prudential com, prudential osgli, prudential com, prudential com giconversions, osgli prudential payment, prudential center com, prudential osgli login

0 Comments